By Amishi Kumar Claros, Brian Clough

Summary:

-

Biomass with carbon removal and storage (BiCRS) includes multiple pathways (such as biochar, biomass removal, and others) that involve recovering organic waste and putting it in durable storage.

-

BiCRS has expanded rapidly, with nearly 400,000 tonnes purchased in 2023. As one of the few durable removal sectors with declining prices, we expect BiCRS will continue to grow in 2024.

-

BiCRS encompasses established and emerging approaches, so buyers must consider durability, cost, and risk tolerance when selecting projects.

-

We think some BiCRS credits– particularly from biochar and biomass removal– are the best choice for buyers pursuing 2030 net-zero targets. Other BiCRS types will interest buyers who want to help accelerate the permanent removal market.

Diversified carbon portfolios, guided by science

Welcome to the first installment of our Carbon Project Insights series. At Rubicon Carbon, our scientists spend a lot of time researching, evaluating, and reviewing carbon projects. We’re excited to share what we know and to help buyers feel informed as they put together high-impact, diversified carbon portfolios.

Each post will introduce a carbon impact approach, including how it works, its benefits and compromises, and its fit in the current market. We’re starting with some of our favorite carbon removal approaches: biomass with carbon removal and storage (BiCRS).

Biomass with carbon removal and storage (BiCRS): an ascendant removal approach

BiCRS refers to several techniques for processing organic waste and durably locking it away, including:

-

Biochar projects produce a charcoal-like substance that can then be applied to soil.

-

Bio-oil projects create a liquid product that can be injected into underground reservoirs.

-

Biomass removal projects bury raw or processed waste in specialized storage containers.

BiCRS was one of the fastest-growing carbon removal approaches in 2023. But, as we’ll see below, the type of organic waste, how it is processed, and how it is stored impacts the scalability and durability of these projects.

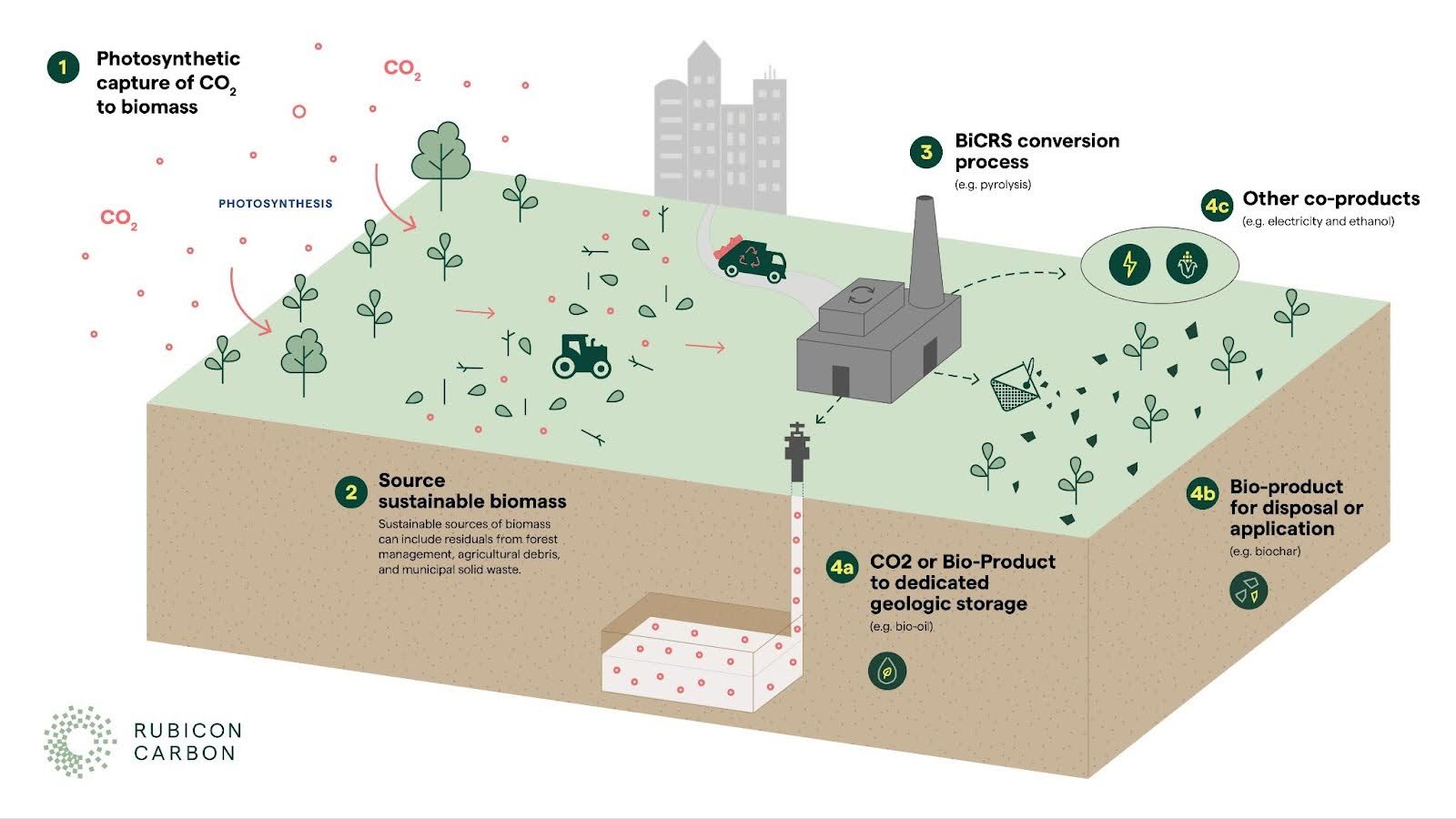

How BiCRS creates carbon removal

BiCRS projects follow the same process: organic waste is collected, processed into a durable form, and put into storage (Figure 1). BiCRS circumvents the natural process of decomposition, which would otherwise return carbon in organic waste to the atmosphere as carbon dioxide or methane. Instead, the processing step transforms it into a durable bio-product, sequestering carbon for hundreds of years. Carbon sources include agricultural and forestry residue and municipal waste from city composting programs.

Figure 1: Overview of the BiCRS process.

How durable are BiCRS credits?

All BiCRS projects are durable, though variations in bio-products and storage lead to some critical differences in project lifespan. Biochar and biomass removal provide long-term temporary storage (over 100 years), while bio-oil projects are effectively permanent (>1000 years) since carbon is stored in well-regulated geologic reservoirs.

BiCRS projects present a low to moderate risk of carbon loss during the project period. In the case of biochar and biomass removal, this could be due to storage methods that fail to arrest natural decomposition, leading to “leakage” of carbon dioxide or methane back into the atmosphere. Since these approaches are so new, the potential impact of these risks is not yet well understood.

Biochar is typically used as a soil amendment, but it can be lost due to soil erosion from changes in land use or management practices. Given the distributed nature of its uses, monitoring, reporting, and verifying the final fate of biochar is an additional complexity and risk. Biochar has a longer track record as a carbon removal method, but the durability of carbon stored in soil is challenging to project.

Regardless of the BiCRS approach, further research is needed to understand how these risks could influence project permanence.

BiCRS underwent rapid growth in 2023

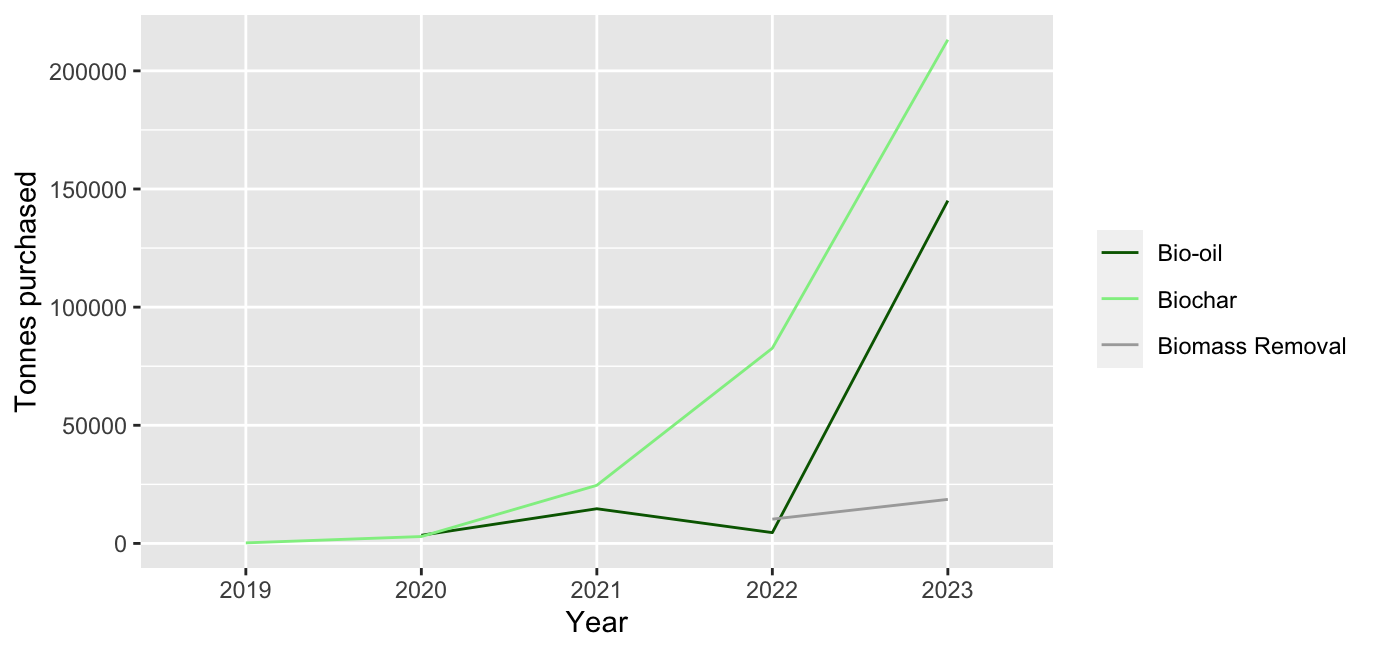

The development of the BiCRS market is a tale of three growth curves (Figure 2). Biochar has long been a mainstay in the market, growing year to year and remaining the dominant BiCRS approach.

Bio-oil projects experienced rapid growth heading into 2023, driven mainly by a handful of significant purchases. Biomass removal only recently took off, but fast growth suggests substantial interest in these projects. Despite only being sold since 2022, they have risen to about five percent of the total market in purchased tonnes.

Figure 2: Total tonnes purchased by year from different BiCRS approaches. Market data from CDR.fyi.

BiCRS credits are relatively affordable, though the average price paid per tonne from 2019 to 2023 ranged widely (Table 1). Bio-oil credits are the most expensive, while biochar credits are the most affordable. However, prices for all have averaged at least $200 per tonne— above what most companies can pay for carbon removal.

That said, we expect prices for some BiCRS approaches to decline over the next few years. Recently, biochar credits have fallen to around $150 per tonne. Biomass removal also offers opportunities for lower-priced credits as supplies grow since these projects tend to require less processing of biomass feedstocks.

Table 1: Average price per tonne (USD) for major BiCRS approaches, 2019-2023.

Biochar: $200

Biomass removal $257

Bio-oil $568

Which BiCRS credits should you add to your portfolio?

Which BiCRS credits are a good fit for your portfolio depends on your goals.

Biochar and biomass removal are best for companies looking for large quantities of durable carbon removal now, perhaps to address a 2030 net zero target. While storage in these projects is less permanent than bio-oil or other engineered CDR methods, they can still provide reliable carbon removal for hundreds of years. They are already relatively affordable and, as discussed above, are likely to come down in price over the next 12-18 months.

Bio-oil projects, while offering higher permanence, are significantly more expensive. Given that these projects require more infrastructure, particularly for transport to and the development of geologic storage sites, the cost of bio-oil credits may decrease more slowly. As a result, we still think bio-oil should mainly be attractive to companies that want to help accelerate the permanent removal market.

Of course, as with all types of CDR, the supply of BiCRS credits is limited in the current market. We recommend that all buyers balance long-term investments in BiCRS with purchases of more readily available, affordable nature-based removals credits, using tools such as our Rubicon Carbon Tonne for removals or our build-your-own portfolio function.

Rubicon Carbon is tracking the carbon removal market

With booming growth and plenty of room for innovation, BiCRS is one of the most exciting sectors of the carbon removal market. We’re looking forward to seeing what 2024 brings.

For more market updates and deep dives on other removal approaches, subscribe to our newsletter and follow our blog.